Inflation is up, and according to Steve Bannon, champion of working-class men and women and host of Real America’s Voice War Room program, most Americans are not ever going to be part of the decision-making process over economics.

Nor are most Americans going to be anything more than a “Russian Surf” owned by the government- that is what Bannon says.

“This US system now is a brutal form of state capitalism that works for the very wealthy and screw everybody else,” Bannon said this week on the War Room.

The financial news is full of data about “Inflation.” Still, the problem is so many Americans are too busy working and trying to survive the mess that DC is causing- struggling to get by- to really pay close attention to which usurper on Capitol Hill is causing this damage to the quality of life for so many Americans.

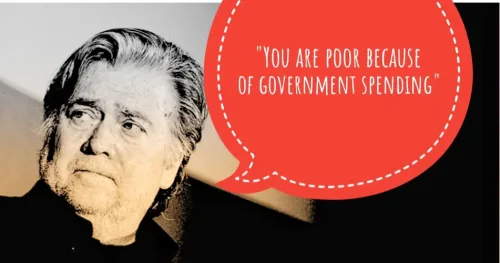

Believe it or not, the topic of rising inflation is urgent for voters to grasp, according to Bannon, a financial expert. But why is it rising so much? He says because the government is overspending.

But why is it rising so much? According to Bannon, it is government over-spending as a leading cause of the problem.

If you follow Bannon and grasp what he is saying about the dangers of the Administrative State, you have heard him talk about the “Keynesian model.” So- what is that?

Here is where Bannon and his expertise are crucial:

KEY POINT:

According to Investopedia.com: The central belief of Keynesian economics is that government intervention can stabilize the economy. Keynes’ theory was the first to sharply separate the study of economic behavior and individual incentives from analyzing broad aggregate variables and constructs.”

Critics of the model attack Keynesian economics for promoting deficit spending, stifling private investment, and causing inflation.

Let’s be honest: economics can be hard to get excited about. The topic seems dry and boring. Would it be more palatable if the story of inflation went something like this:

Once upon a time, a delicate balance between supply and demand existed in a bustling town nestled between rolling hills. Merchants sold their goods, farmers brought their harvest to market, and families went about their daily lives without worry of sudden price hikes. But as the years passed, a shadow began to loom over the town – inflation.

Inflation was like a mischievous sprite, causing prices to dance higher and higher with each passing day. At first, it seemed harmless, barely noticeable to the average villager. But soon, its effects became impossible to ignore.

The town’s baker, renowned for his delicious bread, found himself faced with a dilemma. The cost of flour and yeast, essential ingredients for his masterpieces, soared as inflation tightened its grip. Reluctantly, he raised the price of his loaves, much to the dismay of his loyal customers. They grumbled as they handed over more coins for their morning sustenance, feeling the pinch of inflation in their pockets.

Meanwhile, the blacksmith, whose sturdy tools were essential for the town’s craftsmen, faced a similar plight. The price of iron rose steadily, driven upwards by inflation’s relentless force. Unable to absorb the increased costs, he was forced to pass them on to his customers, who relied on his craftsmanship to ply their trade.

As inflation continued its relentless march, its effects rippled through every corner of the town. Families found themselves struggling to make ends meet as the prices of everyday necessities climbed higher and higher. A trip to the market became a test of budgeting skills, with each purchase scrutinized for affordability.

But why did inflation drive prices up, and why did it impact people so profoundly in their daily lives?

The answer lay in the delicate balance of supply and demand. Inflation, fueled by various factors such as increased demand, rising production costs, or changes in government policies, caused the overall level of prices to rise. As prices climbed, the purchasing power of each coin dwindled, making it more expensive for consumers to buy goods and services.

Inflation meant higher costs for raw materials, wages, and other inputs for businesses. In order to maintain their profit margins, they passed these increased costs onto consumers in the form of higher prices. And thus, the cycle continued, with prices spiraling ever upwards as inflation tightened its grip on the economy.

In the end, inflation was not just a number on a chart or a topic for economists to debate. It was a force that touched the lives of every villager, shaping their daily struggles and challenging their ability to provide for their families. And as long as inflation persisted, its effects would continue to be felt, driving prices ever higher and testing the resilience of the town’s economy.

Did that make it any more fun to think about? What if you could hear from someone who really understands politics, and has a motto: “I may be wrong, but it’s highly unlikely.”

Bannon knows such a guy, he is EJ Antoni, a Heritage economist and frequent guest of the War Room.

In a recent War Room interview, Bannon had Antoni on to talk about what is unfolding in the US Economy.

As Bannon was chatting with Antoni, he wasn’t holding back on his criticism of Keynesian economics. Bannon basically said it’s a flawed approach because it relies too much on the government jumping in and spending a ton of money to boost the economy. Bannon appeared to be saying that the whole idea of just throwing cash into the economy and hoping for the best is like believing in luck rather than solid economic principles.

Bannon is known for not being a fan of the government constantly splurging on spending and borrowing either. He pointed to the last three years as proof that it’s a dead-end strategy.

He’s also not convinced that Keynesian economics takes into account the serious long-term problems that come with racking up too much debt and dealing with inflation.

Both Bannon and Antoni are seriously worried about inflation spiraling out of control and messing with the economy, especially how it hits regular folks in their wallets and in their homes.

Bannon wasn’t pleased with a recent report on inflation from the Washington Post. Bannon said WAPO missed the mark because they only looked at how inflation rates change year over year, ignoring the month-to-month increases in prices.

Bannon has prioritized getting his audience to understand just how important it is to wrap their heads around inflation and why it’s such a big deal.

Antoni jumped in with some insights too, explaining how inflation is driven by a bunch of different things and chatting about how it’s hitting different groups, like young adults and minorities, pretty hard.

Those are the people who need to especially vote their values in the coming elections.

Together, they said that the official stats, like the Consumer Price Index, might not be giving us the full picture of how much it really costs to live, especially when it comes to things like housing, and pointing fingers at government spending and worrying about what all this debt is gonna mean for us down the road.

Bannon, over and over, emphasized that people need to be real about inflation and start making smarter moves with money to keep the government on track, showing that inflation is an essential topic to Bannon on the War Room, and one that he revisits often.

Chek out- EJ Antoni on X

Watch Antoni and Bannon from Tuesday’s War Room: